Budget This Way To Save So Much As A Student

We all know that as a student money is pretty tight and that it is absolutely vital to budget. There are so many expenses as a student including tuition, textbooks, accommodation, entertainment, transportation and food which can be quite overwhelming. Budgeting as a student is a really good idea as it will relieve some of the stress off your shoulders and allow you to focus on what really matters, not just your money situation.

A student who budgets well plans ahead and defines money goals each month. They might do it using an excel spreadsheet or with a pdf budget template. They also track their spending to get an overview of where their money goes so they can evaluate it and make needed changes. These students also are frugal and look out for specials, use their student concession card for discounts, get around using free methods of transportation, pack home meals and look for second hand deals for essential purchases.

It is super simple to put some of these ideas into action as a student and get on top of your money situation. Continue reading for more detailed explanations of each budgeting method as a student.

#1 Define your money goals

Before you start budgeting as a student you should define some money goals so you get a better idea of what you want to implement into your budget. There are many money goals that you can define such as saving a certain amount of your income each month for a car or maybe a trip away with friends. Another common goal is to stop spending money on eat-out meals regularly or to start working more hours at your job to make more money.

Here are more ideas for money goals you can make as a student:

- Buy a small car debt free

- Pay X amount of dollars towards student loans weekly

- Reduce living expenses

- Pay off credit card debt

- Start investing your money

- Start saving to pay a deposit on a house/apartment/investment property

- Pay off all student loans in 5 years

- Save up for a new laptop

I highly suggest that for each money goal you define that you go through the SMART goals progress to make it super achievable and also give yourself an action plan to make sure you get it done!

SMART goals stands for:

- S- specific

- M- measurable

- A- attainable

- R- realistic

- T- time bound

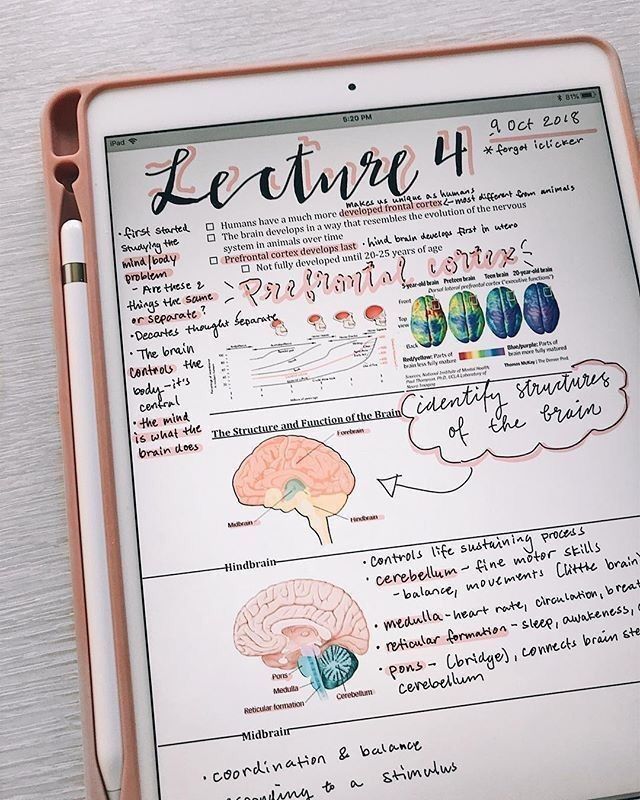

If you like digital planning on your ipad/tablet I highly suggest that you check out my hyperlinked tabs digital student planner which has a goal planner template that you will take you through, step-by-step all the things you need to do to define your money goals (or any goals that you have as a student!) and make sure you achieve them!

The image above is a screenshot of the goal planner page from my digital student planner. As you can see I have gone through the template, step-by-step. I defined my goal, assigned myself an accountability partner, detailed the reason why I want to achieve my goal, made an action plan, set 3 milestones so I know I’m making progress and then later on I will fill out the reflection activities.

Personally, hand writing out my goals like this and going step by step through this process has really motivated me in the past to get things done. The direction this template also gives me has made my goals much more achievable.

#2 Track your spending to get an idea of where your money goes

The next best thing you can do as a student is to track all of your expenses and purchases so you get a better idea of where your money is going. Doing this activity can be a real eye opener. Especially with the rise of digital payments nowadays, the lost act of handing over money makes it easy to go over your daily budget. Forcing yourself to write down everywhere that your money is going can put a stop to mindless spending and also help you evaluate your money situation and make needed changes.

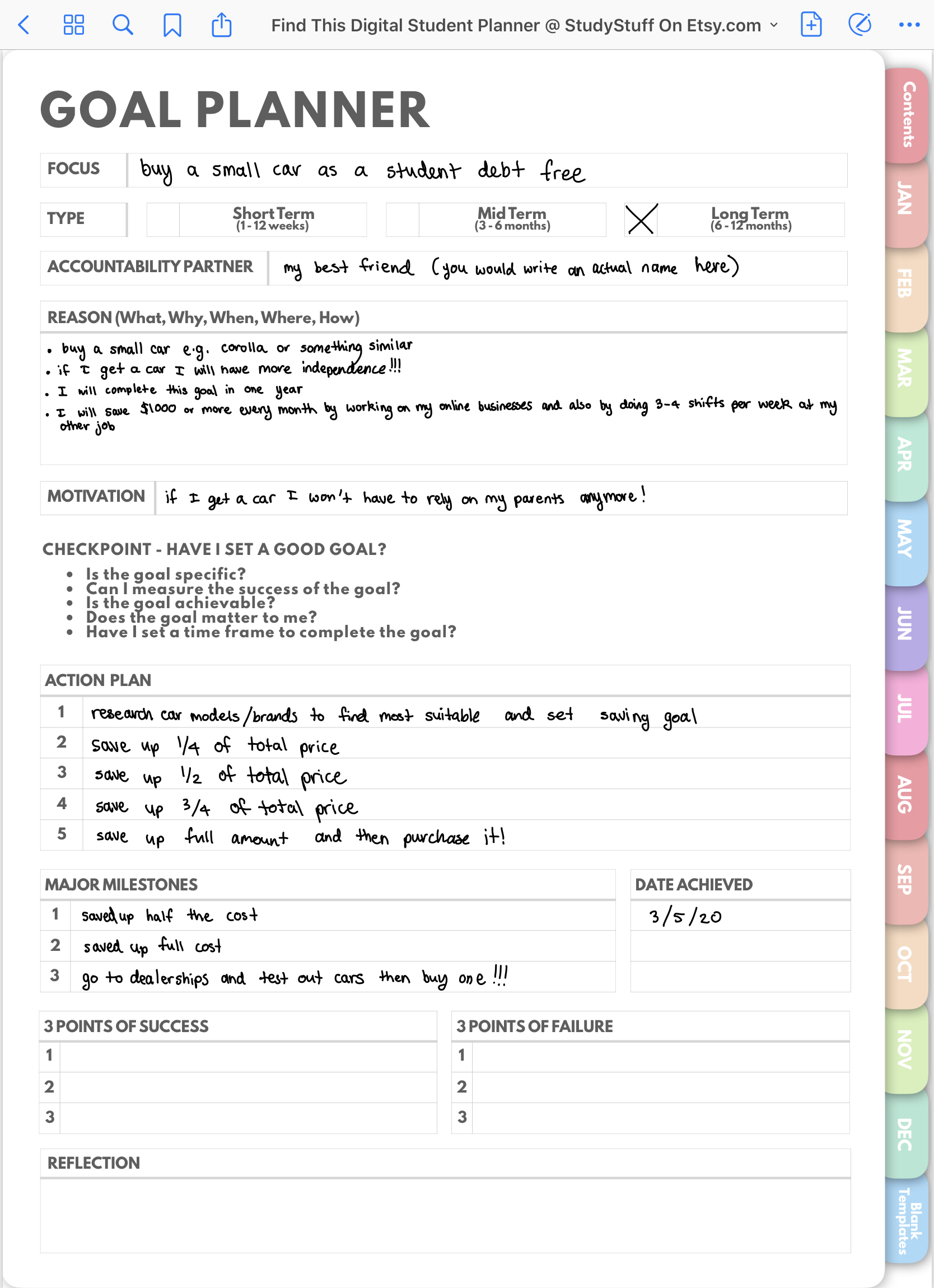

The best thing is that you can do this in my digital student planner as each month there is a new budget tracking template that has an expenses tracker located at the bottom half. In this table you can write down a short description of each expense, then write down how much you budgeted for this expense and how much you actually spent.

You can also think of categorising your expenses by their type.

There are three main types of expenses:

- Fixed expenses – expenses that happen regularly e.g. rent/accomodation expenses, phone bills etc.

- Debt expenses – these are expenses that come from loans e.g. your student loan, a car loan

- Unexpected expenses – expenses you didn’t know about. I suggest each month you start putting money into an emergency fund for these situations.

#3 Record your income

The next step is to record your income. If you use the budget tracker from my digital student planner you can write this information in the table at the top of the page. Recording your income is important as it will allow you to better manage your income and help you decide what percentages go where. You should remember your money goals as you decide what to do with your money.

#4 Set a goal for income, spending, saving and debt each month

The table at the top of the monthly budget tracker in my digital student planner allows you to do this by writing a value in the budget column for each category. At the end of the month, you then write in the next column the actual amount for each category and the difference after that. Hopefully you meet your goals, going above for income and saving below for debt.

As you can see here in an example budget template I have filled out (I made all these figures up), I have made my goals for each category (income, spending, saving and debt) as well as tracked expenses. Also notice the rainbow hyperlinked tabs on the right hand side. They all link to monthly calendars which divide the planner into sections and it allows for easy navigation.

Best Tips To Save Money As A Student

#1 Always be on the lookout for specials

This is especially the case for groceries but also clothing. Always buy on sale! Try to plan your meals around ingredients that are on sale. Do this by looking through specials magazines or online before you head to the shops. Another way to reduce your spending on groceries is to only go shopping once a week. This is so you don’t get tempted to put extra food in your shopping cart all the time.

Also be sure to check out my article on how to create a great meal plan as a student. I also go into a lot more depth about how to make cheaper meals and also shopping tips!

#2 Use your student concession card to get discounts

Not everyone thinks of this but a lot of stores offer student discounts if you show your concession card. I know common ones are movie theatres and also department clothing stores. I also think you can get discounts on tech as a student too!

There are also loyalty programs that you can sign up to as a student to get extra discounts and promo codes. One common one in Australia is student edge which offers a range of discounts for students. I’m sure there are similar programs in your country as well!

#3 Reduce your usage of paid transportation

You might not realise it at first but tapping on and off public transport can add up to a lot of money, especially if you use it daily. I suggest that if you are going somewhere and it is within walking distance you should definitely walk! Not only is it free but you are also getting exercise. If a place is a bit further away you could also ride your bike if you have one. And if it is too far for both of these options and the location is inaccessible by public transport consider carpooling with some friends.

#4 Find alternative entertainment options

Some entertainment options are really expensive and as students we just can’t afford to go all the time. Don’t worry if you are really social because there are plenty of free/very cheap entertainment options out there. Here are some ideas:

- Go on a picnic with friends

- Look for free/cheap concerts in your local areas

- Go to the beach

- Explore your local area e.g. nature trails etc.

#5 Pack lunch from home

Nowadays buying a sandwich out costs over $10. You could make the same thing for $2 or less at home, depending on how fancy your sandwich is. Also just asI was talking about meal planning, you can meal plan your lunches or even easier make double quantities for dinner and bring the 2nd serving as your lunch to University.

#6 Purchase second hand textbooks, clothes, cars etc.

My final tip for being frugal with your money as a student is to purchase second things. This could be textbooks, clothes or even a car. You don’t always need everything in your life to be the newest and best and second hand things can do just a good a job.

Looking For A Tapestry For Your Dorm Room But Have No Idea What Size To Get? Dorm rooms are on average …

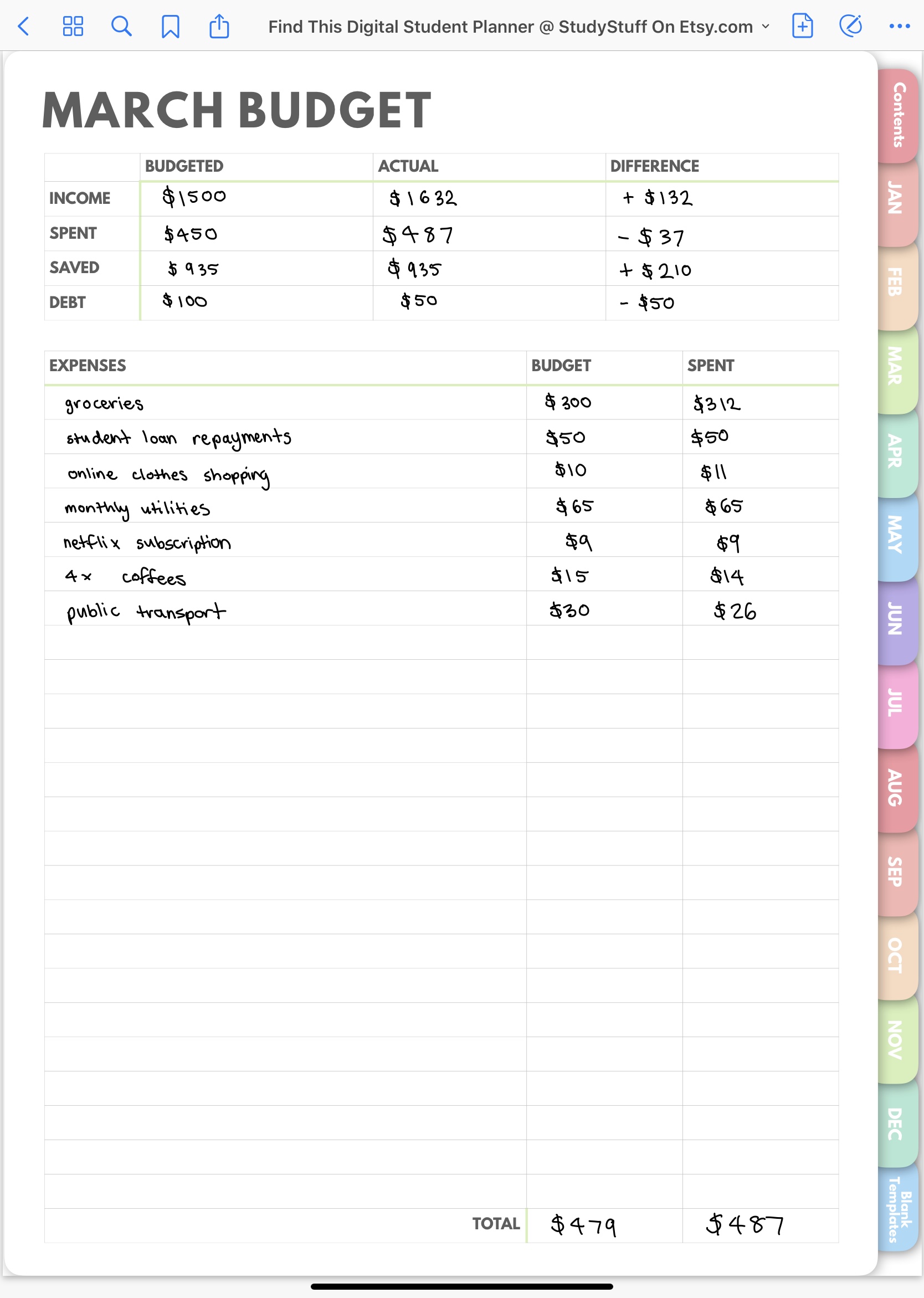

If you take notes using your iPad, you need to know these 12 iPad note taking tips! They will make …

Yes, an iPad is worth it for note taking, especially if you are going to make the most out of …

Going shopping for your dorm room but you are not sure what essentials to buy? Essentials for a dorm room include …

To make a digital bullet journal you firstly need to decide what platform you are going to use. Most people …

To make studying a habit you should commit to it for at least thirty days, put your study goal in …